FG GRANTS THREE-YEAR TAX RELIEF TO 33 COMPANIES, BARS 10 FIRMS

Posted on 04th April, 2022 under News Business

The Federal Government approved the application of 33 companies seeking pioneer status under the Industrial Development Income Tax Act in 2021.

This was contained in the quarterly PSI reports released by the Nigeria Investment Promotion Commission.

The reports also revealed that investments made by the 33 companies during the year amounted to N543.88bn.

It also noted that the government declined the applications submitted by 10 investing firms including the popular FinTech, Flutterwave, during the review period.

The pioneer status is an incentive offered by the Federal Government, which exempts companies from paying income tax for a certain period. This tax exemption can be full or partial.

The incentive is generally regarded as an industrial measure aimed at stimulating investments in the economy.

The products or companies eligible for this pioneer status are products or industries that do not already exist in the country.

An analysis of the first quarter PSI report showed that while the requests of 10 firms were denied, three companies had their applications approved in principle, while six firms were granted PSI for a three-year period.

The report also revealed that 33 firms were benefitting from the tax incentive scheme in Q1, while the requests of 132 companies were still pending.

As at March 31, 2021, the firms granted tax reliefs invested a total of N45.5bn in the Nigerian economy.

The PUNCH had reported in July that Flutterwave was one of the ten companies denied PSI in Q1 2021.

Flutterwave had in February 2022, disclosed that its valuation rose to $3bn, after it was able to raise $250m from a Series D funding round.

At $3bn, using an exchange rate of N570 to one dollar, it means Flutterwave’s valuation is approximately N1.71tn.

A cursory look at the second quarter PSI report for the year 2021 showed that the government granted tax holidays to eight firms who invested an aggregate of N12.8bn.

Seven firms got approval in principle while no application was denied in Q2, the NIPC said.

The report also revealed that 31 firms were benefitting from the tax incentive scheme, while the requests of 160 companies were still pending.

In the third quarter of last year, eight firms were granted PSI while the requests of two companies were rejected.

The firms offered tax holidays invested a whopping N328.5bn into the economy during the review period, the NIPC report said.

The NIPC also revealed that the government granted approval in principle to 16 firms, 168 applications were pending and 35 companies were benefitting from the government’s tax incentive in Q3.

Meanwhile, the latest PSI report from the NIPC revealed that in the last quarter of the year, six companies were granted tax reliefs for a three-year period.

The companies are First Independent Power Company, Cormart Nigeria Limited, Premium Agro Chemicals Limited, West African Soy Industries Limited, Prudent Energy and Services Limited, and Checkers Africa Limited.

These companies contributed N157.08bn to total investments in Q4 2021.

Further analysis of the Q4 report revealed that, during the period, 13 companies had their applications approved in principle while the application of one company was denied.

As at the end of 2021, 46 companies were benefiting from the tax incentive scheme while the requests of 186 companies were still pending.

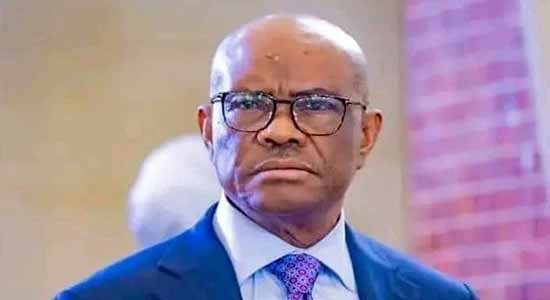

The Acting Executive Secretary, NIPC, Emeka Offor, had in an interview with The PUNCH assured stakeholders that the commission would , this year, partner with local and global stakeholders to boost Foreign Direct Investments into the country.

Emeka had said, “I can assure you that already, we have been getting greater response and inquiries from potential investors, within the country and across the globe.

“We plan to hold more stakeholder engagements in 2022.”

Copyright PUNCH.

Leave a Comment